Note: If my total purchase amount exceeds 222,200 yuan, the amount above this limit must be refunded through the standard departure tax refund process.

Note: If my total purchase amount exceeds 222,200 yuan, the amount above this limit must be refunded through the standard departure tax refund process. Note: If my total purchase amount exceeds 222,200 yuan, the amount above this limit must be refunded through the standard departure tax refund process.

Note: If my total purchase amount exceeds 222,200 yuan, the amount above this limit must be refunded through the standard departure tax refund process.Here are some of our most frequently asked questions. If yours isn't listed, feel free to email us at intlservices@shanghai.gov.cn.

What goods are eligible for this service?

All goods eligible under the existing departure tax refund policy apply, except:

- Items listed as prohibited or restricted in the List of Prohibited Items for Import and Export in the People's Republic of China & Lists of Articles Which are Limited to be Entered or Brought out of Territories as Stipulated by the People's Republic of China;

- Goods exempt from VAT sold by tax-free stores;

- Items excluded by regulations from the Ministry of Finance, the General Administration of Customs, or the State Taxation Administration.

What is the service agreement, and must it be signed personally?

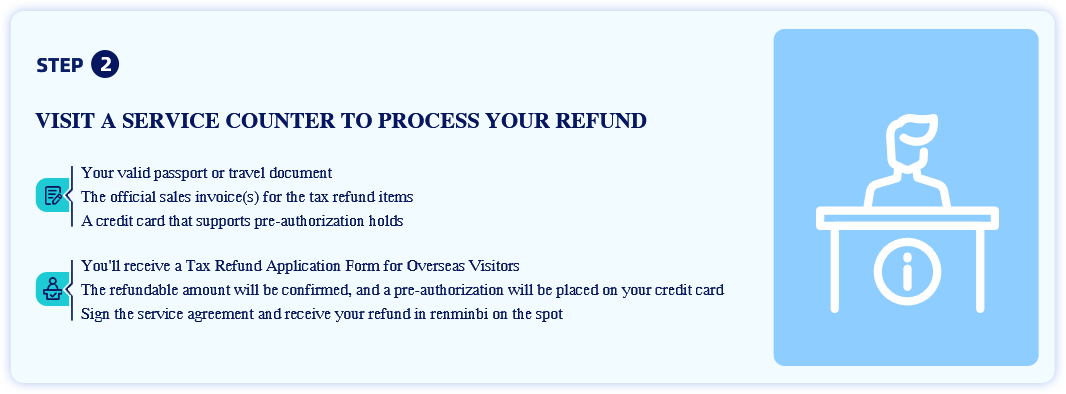

Yes. The service agreement must be signed personally by the overseas visitor. It outlines:

- The visitor's understanding of the rights and obligations;

- The agreed departure timeline and port;

- The visitor's consent to a credit card pre-authorization in exchange for the prepaid refund.

Note: The agreement is provided free of charge.

What is a credit card pre-authorization?

A credit card pre-authorization temporarily freezes an amount equal to the refund on the visitor's card.

- If the visitor completes the refund process, the pre-authorization is canceled.

- If not, the tax refund agency will deduct the refund amount via the pre-authorization.

What is a prepaid refund, or prepaid funds, and how is it given?

The prepaid refund is the renminbi equivalent of the VAT refund paid on the spot.

It can be provided as:

- Cash, or

- Electronic payment

It is funded in advance by the store or the tax refund agency.

How is the prepaid refund amount calculated?

Prepaid refund = Actual VAT refund amount

Actual VAT refund = Invoice amount (including VAT) × refund rate − refund handling fee

What happens if the visitor does not depart on time or from the designated port?

If the visitor fails to fulfill the agreement, the tax refund agency will:

- Deduct the prepaid refund from the credit card via the pre-authorization within three working days of the deadline.

Note: The visitor can still claim the tax refund later through regular procedures upon departure.