Guide to payment services in China available in eight languages (Issue 47)

Issue 47

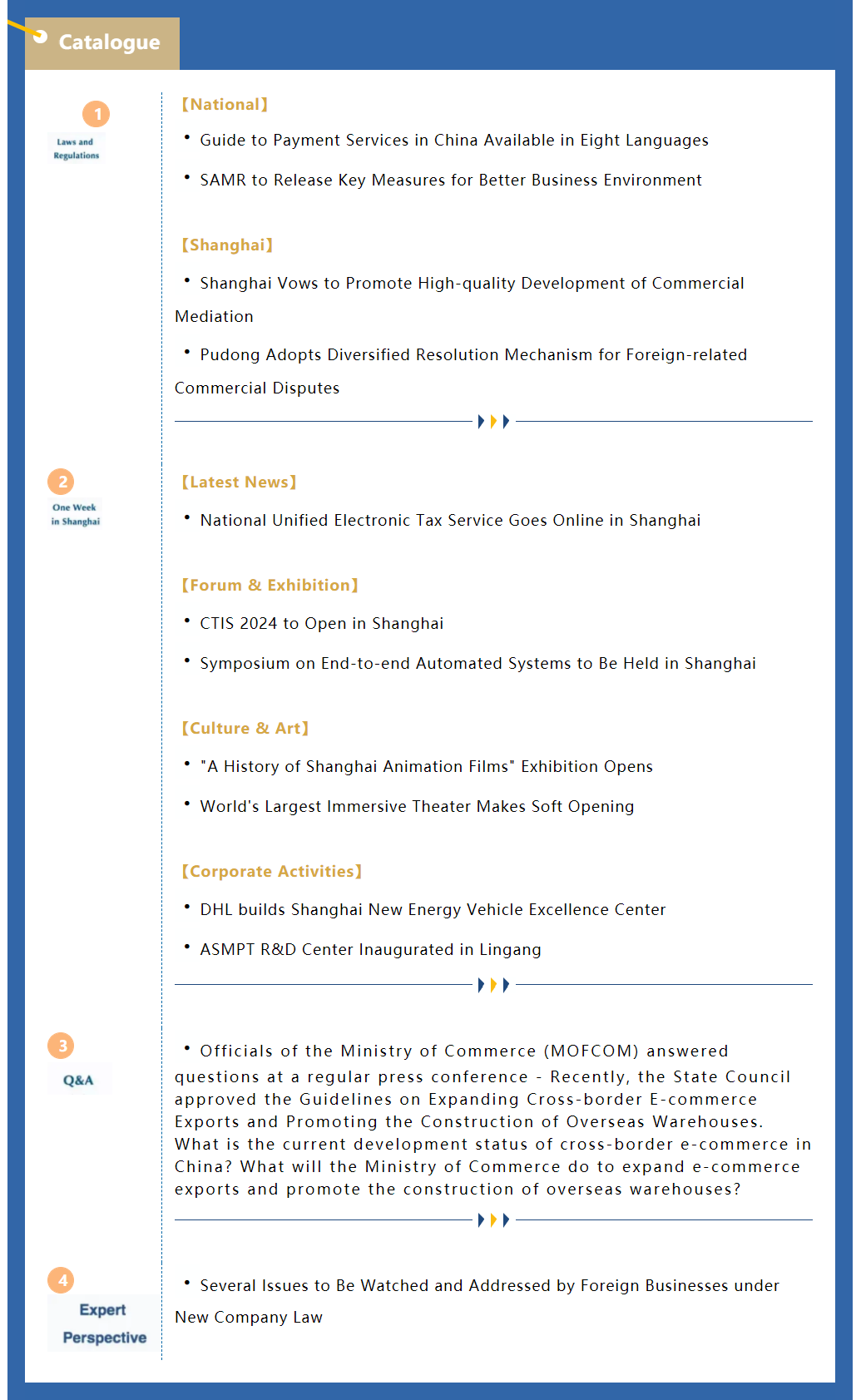

Shanghai Weekly Bulletin

No.1, June 2024

Shanghai Weekly Bulletin is an information service presented by the Foreign Affairs Office of Shanghai Municipal People's Government in collaboration with Wolters Kluwer to foreign-funded enterprises, foreign-related institutions as well as people from overseas living in Shanghai. Covering major national and Shanghai foreign-related news, event information, policy Q&A and interpretations in the past week, it keeps you up-to-date with the latest foreign-related policies and developments in Shanghai.

Laws and Regulations

【National】

1. Guide to Payment Services in China Available in Eight Languages

【Keyword: Payment】

The People's Bank of China (PBC) recently released the Guide to Payment Services in China in eight languages. In addition to its Chinese and English versions, the Guide is now also available in German, Spanish, French, Japanese, Korean and Russian. It covers bank card, mobile payment, cash, bank account, and e-CNY.

Source: International Services Shanghai

2. SAMR to Release Key Measures for Better Business Environment

【Keyword: Business Environment】

The State Administration for Market Regulation (SAMR) released on May 29, 2024 the Key Measures for Market Regulators to Improve Business Environment (2024 Version) for public comments until June 28, 2024. The document outlines 40 measures in ten aspects, including improving the systems and rules for the improvement of business environment in the field of market regulation, making business entities' access to and exit from market more convenient and regulated, and keeping a fair and orderly market competition.

Source: SAMR

【Shanghai】

1. Shanghai Vows to Promote High-quality Development of Commercial Mediation

【Keyword: Commercial Mediation】

Shanghai High People's Court and other six government departments in the city recently issued the Several Measures to Promote the High-quality Development of Commercial Mediation. The document proposes eight measures, including strengthening the institutional guarantee for the development of commercial mediation, supporting the development and growth of commercial mediation organizations, implementing the commercial mediation “Harmony” plan, and piloting the "mediation plus notarization" enforcement empowerment plan.

Source: Shanghai Municipal Bureau of Justice

2. Pudong Adopts Diversified Resolution Mechanism for Foreign-related Commercial Disputes

【Keywords: Foreign-related; Commercial Disputes】

The Standing Committee of the Seventh People's Congress of Pudong voted to pass the Several Provisions on Improving the Diversified Resolution Mechanism for Foreign-related Commercial Disputes in Pudong New Area, which took effect on June 1, 2024. The document covers building one-stop dispute resolution centers, mobilizing resources to form social synergy, optimizing supporting service mechanisms, as well as agreed offshore jurisdiction, new dispute resolution methods, and cooperation mechanisms.

Source: Pudong Release

One Week in Shanghai

【Latest News】

1. National Unified Electronic Tax Service Goes Online in Shanghai

【Keyword: Electronic Tax Service】

The national unified and standardized electronic tax service will go online this month. It would automatically recommend a suitable tax declaration model for an enterprise based on its invoice issuance and acquisition, historical declaration records, and registration and certification. It will also automatically extract data, calculate tax amounts, and pre-fill declarations to make the tax declaration experience more worry-free.

Source: Shanghai Municipal Tax Service

【Forum & Exhibition】

1. CTIS 2024 to Open in Shanghai

【Keyword: CTIS】

The Consumer Technology & Innovation Show 2024 (CTIS 2024) will be held on June 13-15 at the Shanghai New International Expo Center. Under the theme "Innovate and enlighten the future", the CTIS 2024 will have a total exhibition area of 40,000 square meters, bringing together more than 600 exhibitors from China and the rest of the world. It is expected to attract more than 40,000 professional visitors and industry elites.

Source: Consumer Technology & Innovation Show

2. Symposium on End-to-end Automated Systems to Be Held in Shanghai

【Keyword: End-to-end Automated Systems】

The Symposium on End-to-end Automated Systems and the Technical Meetup of the Autonomous Grand Challenge, Bibling of CVPR 2024 Workshop will be held in Shanghai on June 8, 2024. The symposium will serve as a leading event for the Autonomous Grand Challenge, inviting participating teams to share their competition plans and providing a platform for global autonomous driving developers and operators to exchange ideas and explore collaborative innovations.

Source: Shanghai Artificial Intelligence Laboratory

【Culture & Art】

1. "A History of Shanghai Animation Films" Exhibition Opens

【Keyword: Shanghai Animation Films】

The "Animating China - A History of Shanghai Animation Films" recently opened at the Shanghai Minsheng Art Museum, which is the first exhibition curated by the museum after it moved to a new venue on the Weihai Road. The exhibition has set up five chapters, namely "Prologue Hall", "Painting Journey", "Tour of Classics", "Media Exploration" and "Contemporary Echoes". The exhibition will last until October 8, 2024.

Source: Shanghai Tourism

2. World's Largest Immersive Theater Makes Soft Opening

【Keyword: Immersive Theater】

Puy du Fou's much-anticipated SAGA City of Light experience show announced soft opening in Shanghai on May 28, 2024. The project has a total area of 46,000 square meters and is committed to providing a new "offline real-life movie" experience. Every visitor will feel as if they were walking into a real-life performance and embarking on a moving entertainment experience. It is expected to become a benchmark for Shanghai's urban renewal initiative.

Source:International Services Shanghai

【Corporate Activities】

1. DHL builds Shanghai New Energy Vehicle Excellence Center

【Keyword: DHL】

Global logistics service provider DHL recently announced the establishment of its New Energy Vehicle Excellence Center in Shanghai, aiming to provide support for NEV companies and customers in related fields to expand local market and promote global development. This is the first new energy vehicle excellence center established by DHL Group in China after it established such centers in Indonesia, Mexico, the United Arab Emirates and Britain.

Source: Pudong Release

2. ASMPT R&D Center Inaugurated in Lingang

【Keyword: ASMPT】

ASMPT Semiconductor Solutions (Shanghai) inaugurated its R&D center at the Moore Park, Zhangjiang Science and Technology Port, Lingang Special Area. The R&D center will stand at a new starting point and strive to make its advanced technologies take root in China through independent R&D and product innovation, and provide high-quality and competitive products and solutions.

Source: Shanghai Lingang

Q&A

Q1: Officials of the Ministry of Commerce (MOFCOM) answered questions at a regular press conference - Recently, the State Council approved the Guidelines on Expanding Cross-border E-commerce Exports and Promoting the Construction of Overseas Warehouses. What is the current development status of cross-border e-commerce in China? What will the Ministry of Commerce do to expand e-commerce exports and promote the construction of overseas warehouses?

A1: Cross-border e-commerce is a vital force in driving China's foreign trade and an important trend in the development of international trade. In recent years, cross-border e-commerce has been coordinated and linked with new foreign trade infrastructures such as overseas warehouses, with rapid development, great growth potential and strong driving effect. In the past five years, China's cross-border e-commerce trade value has increased more than 10 times. In the first quarter of 2024, cross-border e-commerce imports and exports amounted to RMB 577.6 billion, a year-on-year increase of 9.6%, and export value amounted to RMB 448 billion, up 14% year on year. According to preliminary statistics, there are more than 120,000 cross-border e-commerce entities in China, more than 1,000 cross-border e-commerce industrial parks, more than 2,500 overseas warehouses with a total area of more than 30 million square meters. Among them, more than 1,800 overseas warehouses are dedicated to serving cross-border e-commerce sales, with a total area of more than 22 million square meters.

In the next stage, we will move faster to unveil the Guidelines on Expanding Cross-border E-commerce Exports and Promoting Overseas Warehouse Construction, work with relevant departments and localities to ensure sound implementation, and work on four priorities:

Firstly, empowering industrial development. On the basis of China's 165 cross-border e-commerce pilot zones, combined with the industrial and geographic advantages of various regions, we will drive more enterprises to participate in international trade through cross-border e-commerce.

Secondly, we will strengthen the cultivation of e-commerce entities. We will guide cross-border e-commerce pilot zones to actively cultivate enterprises and instruct upstream and downstream small and medium-sized enterprises to explore digital transition. We will hold special training on new foreign trade formats to strengthen capacity building.

Thirdly, we will strengthen exchanges and reference. We will hold on-site meetings to strengthen the exchange of typical cases and experiences, improve industry self-discipline and guide orderly competition.

Fourthly, we will create favorable environment. We will participate in multilateral and bilateral cooperation, and include cross-border e-commerce topics in free trade agreement negotiations, joint committees, and mixed committees. We will support cross-border e-commerce pilot zones, industries, and enterprises to carry out international exchanges and cooperation.

Source: MOFCOM

Expert Perspective

Several Issues to Be Watched and Addressed by Foreign Businesses under New Company Law

By: He Kan, Chen Leyi, Gao Fangjiao, Liu Zijing, Yang Yanhua (Junhe Law Firm)

[Continuing from the Last Issue]

Q15: Preemptive right of other shareholders in case of share transfer

The current Company Law stipulates that if a shareholder transfers his shares to a third party, he must obtain the consent of more than half of the other shareholders, and the other shareholders shall have the right of first refusal under the same conditions. This provision is mainly based on the consideration of the personal nature of limited liability companies, to avoid the introduction of new shareholders who are not accepted or welcomed by existing shareholders. Unwelcomed new shareholders may lead to adverse consequences such as business conflicts and corporate deadlock. However, the dual setting of "consent right + preemptive right" has also triggered discussions on whether the law gives existing shareholders excessive concessions.

Article 84 of the New Company Law makes two significant changes to equity transfers. First, it deletes the consent rights of other shareholders when a shareholder plans to transfer shares to a third party. When a shareholder transfers shares to a third party, he or she only needs to notify other existing shareholders. If other shareholders fail to respond after receiving the written notice, the rule is changed from "deemed to have agreed to the transfer" to "deemed to have waived the right of first refusal"; Second, on the premise of retaining the right of first refusal, the Fourth Judicial Interpretation of the Company Law is reinstated that the "equal conditions" are the same "quantity, price, payment method and deadline" stated in the equity transfer notice, which detailed the implementation process of the right of first refusal at the legal level.

In most cases, foreign companies and domestic companies often establish joint ventures based on business cooperation needs, which is more like a "marriage" between the two companies. They do not want the intervention of a third party. Sometimes, the shareholder agreement even stipulates that the joint venture company cannot introduce third-party shareholders. However, according to the provisions of the New Company Law, a shareholder can directly transfer the shares he holds without the consent of the other party, which may undermine the stability of the "marriage". Especially when a foreign company is a minority shareholder, if the majority shareholder suddenly leaves the company and the minority shareholder does not have enough money to acquire the majority shareholder's shares, the minority shareholder may be forced to get along with a completely unfamiliar new shareholder. Fortunately, Article 84 of the New Company Law also stipulates an exception that "if the company's articles of association have other provisions on equity transfer, such provisions shall prevail." Therefore, it is recommended that certain restrictions on shareholder transfers should still be made in the joint venture contract/shareholder agreement and articles of association to maintain the stability of the cooperative relationship between the two parties.

Article 88 of the New Company Law clarifies how to share responsibilities between the transferor and the transferee during a share transfer. Firstly, if the capital contribution period has not expired, the capital contribution obligation after the equity transfer shall be borne by the transferee, but the transferor shall bear supplementary liability for the capital contribution that the transferee fails to pay on time. Secondly, if the equity transfer is completed with uncontributed or defective capital contribution, and the transferor and the transferee shall bear joint and several liability within the scope of the insufficient capital contribution; if the transferee is not aware of and should not be aware of the above-mentioned situation, the transferor shall bear the responsibility. From the perspective of M&A transactions, in the future, if a foreign-invested company intends to sell its equity before fulfilling its capital contribution obligations, it may not be able to simply transfer the obligations to the buyer; similarly, the buyer will also pay more attention to the seller's capital contribution responsibility for the transferred equity. The method of the seller fulfilling its capital payment obligation before completing the transaction may be widely adopted. For the foreign-invested company, the arrangement will also avoid the risk of it being held responsible for the buyer's subsequent default on capital contribution after delivery.