Shanghai deepens the development of social credit system (Issue 85)

Issue 85

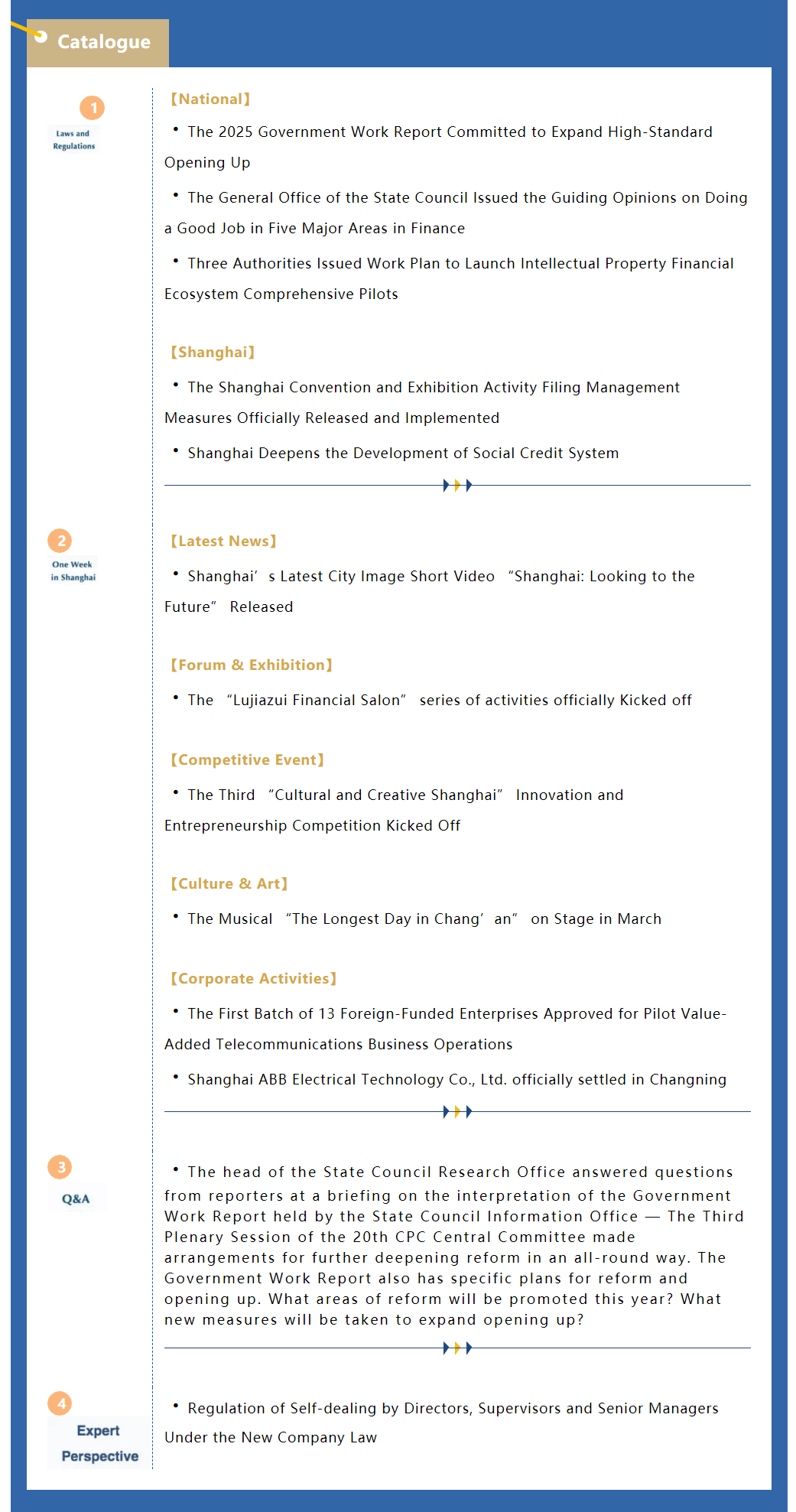

Shanghai Weekly Bulletin

No.2, March 2025

Shanghai Weekly Bulletin is an information service presented by the Foreign Affairs Office of Shanghai Municipal People's Government in collaboration with Wolters Kluwer to foreign-funded enterprises, foreign-related institutions as well as people from overseas living in Shanghai. Covering major national and Shanghai foreign-related news, event information, policy Q&A and interpretations in the past week, it keeps you up-to-date with the latest foreign-related policies and developments in Shanghai.

Laws and Regulations

【National】

1. The 2025 Government Work Report Committed to Expand High-Standard Opening Up

【Keywords: Government Work Report】

From March 5th to 11th, the Third Session of the 14th National People's Congress was convened. The Government Work Report proposed to expand high-level opening up and actively stabilize foreign trade and investment.

Source: Website of the Chinese Government

2. The General Office of the State Council Issued the Guiding Opinions on Doing a Good Job in Five Major Areas in Finance

【Keywords: Finance】

Recently, the General Office of the State Council issued the Guiding Opinions on Doing a Good Job in Five Major Areas in Finance, which clarified the five key financial areas and main focus, and proposed policy measures from the aspects of improving the service capabilities and supporting intensity of financial institutions, strengthening the service functions of financial markets and infrastructure, and strengthening policy guidance and supporting facilities.

Source: Website of the Chinese Government

3. Three Authorities Issued Work Plan to Launch Intellectual Property Financial Ecosystem Comprehensive Pilots

【Keywords: Intellectual property, Finance】

Recently, the National Financial Regulatory Administration (NFRA), the National Intellectual Property Administration, and the National Copyright Administration jointly issued the Work Plan for Intellectual Property Financial Ecosystem Comprehensive Pilot, deciding to launch comprehensive pilots of the intellectual property financial ecosystem in Beijing, Shanghai, Jiangsu Province, Zhejiang Province, Guangdong Province, Sichuan Province, Shenzhen, Ningbo, etc. The Work Plan proposes that by 2027, these pilot areas will have established comprehensive pilot zones of intellectual property financial ecosystem with convenient and efficient services, smooth information sharing, and complete systems and mechanisms.

Source: NFRA

【Shanghai】

1. The Shanghai Convention and Exhibition Activity Filing Management Measures Officially Released and Implemented

【Keywords: Convention and exhibition activity】

Recently, the Shanghai Municipal Commission of Commerce issued the Shanghai Convention and Exhibition Activity Filing Management Measures, which clearly stipulates that the organizers of convention and exhibition activities should complete pre-exhibition filing with the municipal commerce authority before releasing exhibition information. This document took effect on March 1, 2025, and will remain valid until February 28, 2030.

Source:Shanghai Municipal Commission of Commerce

2. Shanghai Deepens the Development of Social Credit System

【Keywords: Social credit】

Recently, the Shanghai Social Credit System Development Joint Conference Office issued the Key Tasks for the Development of the Shanghai Social Credit System in 2025, proposing 21 work tasks in seven areas, including conducting research on the social credit system during the "15th Five-Year Plan" period, serving the "Five Centers" development, strengthening financing credit service functions, and deepening the tiered and categorized supervision of credit in key areas.

Source: Shanghai Municipal Development & Reform Commission

One Week in Shanghai

【Latest News】

1. Shanghai's Latest City Image Short Video "Shanghai: Looking to the Future" Released

【Keywords: Looking to the Future】

Recently, Shanghai released its latest city image short video "Shanghai: Looking to the Future". With the theme of "A city of dreams, a gateway to the world", the short video showcases a vibrant city of dreams and a bright era of dream chasing.

Source:Shanghai Release

【Forum & Exhibition】

1. The "Lujiazui Financial Salon" series of activities officially Kicked off

【Keywords: Lujiazui Financial Salon】

Recently, the launching ceremony of "Lujiazui Financial Salon" was grandly held. The Lujiazui Financial Salon is set to host 40 seminars this year, focusing on banking and insurance, securities and futures, venture capital, and listed companies. The Salon will bring together a wide range of resources including regulatory agencies, factor markets, financial institutions, technology companies, etc., to meticulously build a high-level and in-depth dialogue and communication platform.

Source: Lujiazui Financial Salon

【Competitive Event】

1. The Third "Cultural and Creative Shanghai" Innovation and Entrepreneurship Competition Kicked Off

【Keywords: Cultural and Creative Shanghai】

On March 4, the third "Cultural and Creative Shanghai" Innovation and Entrepreneurship Competition kicked off. The Competition adopts a "3+1" track setting, including three main tracks of "Intelligent Future+", "Original Content Production+", "Cultural and Creative Empowerment of Fashion Consumer Goods+" and a special track of "Music Innovation+", focusing on hot industrial fields such as digital culture and creativity, content IP, cultural consumption, and fashion design.

Source:Cultural and Creative Shanghai

【Culture & Art】

1. The Musical "The Longest Day in Chang'an" on Stage in March

【Keywords: The Longest Day in Chang'an】

From March 13 to 23, the musical "The Longest Day in Chang'an" will be staged at Great Shanghai Theater of Shanghai Huangpu Cultural Center. This musical is adapted from Mr. Ma Boyong's novel of the same name. It brings together an elite creative team in the field of Chinese musicals and a cast of top-tier actors, striving to recreate the magnificence of the Tang Dynasty with the most exquisite skills and showcase the mysterious and charming oriental aesthetics.

Source:Shanghai Huangpu

【Corporate Activities】

1. The First Batch of 13 Foreign-Funded Enterprises Approved for Pilot Value-Added Telecommunications Business Operations

【Keywords: Value-added telecommunications business】

The Ministry of Industry and Information Technology (MIIT) recently granted approval for value-added telecommunications business pilots to 13 foreign-funded enterprises in Beijing, Shanghai, Hainan and Shenzhen. Siemens Digital Health Technology (Shanghai) Co., Ltd. and three other foreign-funded enterprises in Shanghai are on the approval list.

Source:MIIT

2. Shanghai ABB Electrical Technology Co., Ltd. officially settled in Changning

【Keywords: ABB】

On March 5, Shanghai ABB Electrical Technology Co., Ltd., a newly established member of ABB Group in China, officially settled in Changning. The company will provide users with complete solutions covering switches and sockets, home and building automation, terminal power distribution and energy consumption management, and drive the progress of artificial intelligence and digitalization.

Source:Shanghai Changning

Q&A

Q1:The head of the State Council Research Office answered questions from reporters at a briefing on the interpretation of the Government Work Report held by the State Council Information Office — The Third Plenary Session of the 20th CPC Central Committee made arrangements for further deepening reform in an all-round way. The Government Work Report also has specific plans for reform and opening up. What areas of reform will be promoted this year? What new measures will be taken to expand opening up?

A: This year's Report closely revolves around the implementation of the reform plans set by the Third Plenary Session of the 20th CPC Central Committee. The Report reflects the spirit and requirements of the reform, and emphasizes the implementation of the annual reform tasks, focusing on both comprehensive advancement and breakthroughs in key areas, especially promoting the accelerated implementation of landmark reform measures. The reform measures mentioned in the Report cover a wide range of areas, and here I will highlight three of them. In terms of fiscal and taxation system reform, this year we will accelerate the process of moving the consumption tax collection of certain categories of goods to the downstream and allocating those revenues to local governments. This reform has been proposed for many years, and we are determined to accelerate it this year. This reform has a wide impact and obvious benefits. It is conducive to alleviating the financial pressure on production enterprises and will not increase the burden on taxpayers. It will also help guide local governments to improve the consumption environment and actively drive local consumption. In terms of education reform, the Report proposes to gradually implement free preschool education, which is an important reform measure to promote the universal and inclusive development of preschool education. It has many benefits for the people and for social development, helping to reduce family childcare and education costs, and also helping to promote the long-term balanced development of the population. In terms of medical and health reform, the Report emphasizes the need to deepen the reform of public hospitals oriented towards public welfare, which will help to effectively improve the service quality of public hospitals and make medical treatment more reassuring and convenient for the people. The Report mentions many such breakthrough and landmark reform measures, but due to time constraints, I cannot elaborate one by one.

Opening up is a crucial move for China's development. The Chinese Government will unswervingly promote opening up and open the door wider to the outside. This year’s Report also proposes many new opening-up measures, emphasizing the need to steadily expand institutional opening-up, orderly expand independent opening-up and unilateral opening-up, and continue to create a first-class business environment that is market-oriented, law-based, and internationalized. Specifically, for example, the Report proposes to vigorously encourage foreign investment. This year, we will further relax market access for foreign investment, expand pilot openings in fields such as telecommunications, medical care, and education, revise and expand the Catalogue of Encouraged Industries for Foreign Investment, and expand the fields and scope of foreign investment. For another example, we will focus on strengthening service guarantees for foreign-funded enterprises, optimize the full-process service for projects, widen the financing channels for foreign-funded enterprises, and facilitate personnel exchanges. There are actually many more opening-up measures mentioned in this year's Report. These measures will provide more and better opportunities for overseas enterprises and foreign investors to develop in China. We believe that as long as foreign investors seize favorable opportunities, make long-term plans in China and actively invest and cooperate, they stand to benefit more from China's continuously expanding market.

Source:State Council Information Office

Expert Perspective

Regulation of Self-dealing by Directors, Supervisors and Senior Managers Under the New Company Law

By Fu Changyu, Jiang Xuan (Zhong Lun Law Firm)

[Continued from the Previous Issue]

II. Regulation of Indirect Self-dealing and Breakthroughs in Judicial Practice

In China’s corporate governance and judicial practice, the more common scenario that harms the interests of foreign-funded enterprises is often where directors, supervisors and senior managers conduct indirect self-dealing or related-party transactions with foreign-funded enterprises through enterprises controlled by their close relatives or related parties. Previously, due to the wording of the old Company Law, it was often necessary to interpret the scope of self-dealing regulation broadly in order to fairly and impartially resolve disputes and protect the interests of companies.

The "Shanghai Lan Trading Co., Ltd. vs Jiang et al." case, which involved a dispute over liability for damage to company interests, heard by the Shanghai Second Intermediate People's Court ("Shanghai Second Intermediate Court") and included in the "First Batch of Typical Cases of Protecting Foreign Investment Rights and Interests in Accordance with the Law" released by the Supreme People's Court, is a typical case of this type. The case details are as follows:

Basic Facts

In September 2013, a French company Lan, along with some other investors from France and Belgium, jointly established Shanghai Lan Trading Co., Ltd. ("Shanghai Lan Company"). Jiang served as the general manager of Shanghai Lan Company and was fully responsible for the company's daily management. In September 2017, Shanghai Lan Company signed a "Decoration Project Contract" with L Company, entrusting L Company to renovate its office premises. Subsequently, Jia Company replaced L Company to carry out the construction, and Shanghai Lan Company paid Jia Company over RMB 1.5 million for renovation fees. Jiang's spouse held 99% equity of Jia Company, but Jiang did not report this to Shanghai Lan Company. Shanghai Lan Company therefore filed a lawsuit against Jiang and Jia Company, claiming for compensation. It believed that Jiang took advantage of his position and transferred the decoration costs far higher than the actual amount to Jia Company and a Mr. Zhong by signing a contract with Jia Company, and that Jiang and Jia Company have misappropriated the property of Shanghai Lan Company.

Judgment Result

The Shanghai Second Intermediate People's Court, after hearing the case, held that, according to Article 148, Paragraph 1, Item 4, of the Company Law of the People's Republic of China (Revised in 2018) ("2018 Company Law"), directors and senior managers shall not enter into contracts or engage in transactions with the company except as provided in the company's articles of association or with the consent of the shareholders' meeting or shareholders' general meeting. In this case, Jiang was a senior manager of Shanghai Lan Company; in the absence of provisions in the Shanghai Lan Company's articles of association permitting directors and senior managers to enter into contracts or engage in transactions with the Company, if Jiang intended to facilitate transactions between Jia Company and Shanghai Lan Company, he should have, based on his fiduciary duty, proactively disclosed to the shareholders' meeting of Shanghai Lan Company the fact that his spouse held 99% equity in Jia Company and directly controlled that company, so that the shareholders' meeting of Shanghai Lan Company could decide whether to agree to enter into contracts or engage in transactions with it. Yet, Jiang deliberately concealed his relationship with Jia Company and conducted transactions with Jia Company on behalf of Shanghai Lan Company, which violated Article 148, Paragraph 1, Item 4, of the 2018 Company Law. The Shanghai Second Intermediate People's Court thus ordered Jiang, Jia Company and Mr. Zhong to return the transaction proceeds of more than RMB 340,000 that exceeded the market fair value to Shanghai Lan Company. None of the parties appealed against the ruling of first instance.

Significance

The Supreme People's Court deems that this case "accurately determined the self-dealing of senior executives and timely safeguarded the legitimate rights and interests of the foreign-funded enterprise". This case provides a substantive interpretation of the self-dealing provisions in Article 148, Paragraph 1, Item 4, of the 2018 Company Law, expanding the scope of self-dealing from senior executives themselves to include the close relatives of senior executives or enterprises directly controlled by close relatives, demonstrating the institutional value of the Company Law in regulating senior executives' conducts and safeguarding corporate interests. The substantive interpretation method adopted in this case has been fully recognized and reflected in the new Company Law revised in 2023. Article 182, Paragraph 1, of the new Company Law expands the scope of self-dealing to include "enterprises directly or indirectly controlled by their close relatives".

[To be Continued]