Central Financial Commission releases guidelines to support development of Shanghai as an international financial center (Issue 99)

Issue 99

Shanghai Weekly Bulletin

No.4, June 2025

Shanghai Weekly Bulletin is an information service presented by the Foreign Affairs Office of Shanghai Municipal People's Government in collaboration with Wolters Kluwer to foreign-funded enterprises, foreign-related institutions as well as people from overseas living in Shanghai. Covering major national and Shanghai foreign-related news, event information, policy Q&A and interpretations in the past week, it keeps you up-to-date with the latest foreign-related policies and developments in Shanghai.

Laws and Regulations

【National】

1.Central Financial Commission Releases Guidelines to Support Accelerated Development of Shanghai as an International Financial Center

[Keywords: Shanghai, International financial center]

The Central Financial Commission recently released the Guidelines on Supporting the Accelerated Development of Shanghai as an International Financial Center. The document outlines six key measures: deepening the development of financial markets, enhancing the capabilities of financial institutions, improving financial infrastructure, expanding high-standard two-way financial opening-up, raising the quality and efficiency of financial services for the real economy, and effectively safeguarding financial security while remaining openness.

Source:Xinhuanet

2.PBC Unveils Eight Major Measures to Further Financial Opening-up

[Keyword: Finance]

At the opening ceremony of the 2025 Lujiazui Forum, the Governor of the People’s Bank of China (PBC) announced eight major initiatives to deepen financial opening-up. The initiatives include: establishing a trade repository for the interbank market, setting up an international operations center for the digital RMB, launching a personal credit reporting agency, piloting a comprehensive reform program for offshore trade finance services in the Lin-gang Special Area, developing Free Trade Offshore Bonds, optimizing and upgrading the functions of Free Trade Accounts, piloting innovative structural monetary policy tools in Shanghai, and working with the China Securities Regulatory Commission to explore the launch of RMB foreign exchange futures trading.

Source: CCTV News

3.Issuance of Electronic Apostilles Piloted by the Ministry of Foreign Affairs

[Keywords: Electronic apostille]

Starting from June 18, 2025, the Ministry of Foreign Affairs will pilot the issuance of electronic apostilles for certificates of origin issued by the China Council for the Promotion of International Trade (CCPIT). From the date of the pilot program, applicants who apply for certificates of origin through CCPIT may simultaneously request an electronic apostille, enabling streamlined, one-stop services without the need for in-person visits.

Source: Consular Express

4.CSRC Allows Qualified Foreign Investors to Partake in ETF Options Trading

[Keywords: Foreign investment, ETF]

The China Securities Regulatory Commission (CSRC) recently issued the Announcement on Allowing Qualified Foreign Institutional Investors (QFII) and Renminbi Qualified Foreign Institutional Investors (RQFII) to Participate in Stock Option Trading. The announcement explicitly permits qualified foreign investors to engage in trading of exchange-traded open-end index fund options (ETF options) listed on trading venues approved by the State Council or the CSRC. The new policy will take effect on October 9, 2025.

Source: CSRC

5.SAFE Proposes Nine Targeted Policies to Deepen Reform of Foreign Exchange Administration for Cross-border Investment and Financing

[Keywords: Cross-border investment and financing, Foreign exchange administration]

Recently, the State Administration of Foreign Exchange (SAFE) is soliciting public opinions on the Notice on Matters Concerning the Deepening of Reform in Foreign Exchange Administration for Cross-border Investment and Financing (Draft for Comments). The closing date to submit feedback is July 18.

Source: SAFE

【Shanghai】

1.Action Plan to Support the Development of Shanghai as an International Financial Center Unveiled

[Keywords: Shanghai, International financial center]

The National Financial Regulatory Administration, in collaboration with the Shanghai Municipal People’s Government, has recently issued the Action Plan on Supporting the Development of Shanghai as an International Financial Center. The plan focuses on five key areas, including: concentrating financial institutions to enhance the quality and strength of the financial service functions, advancing the development of the “five key financial pillars” (namely, sci-tech finance, green finance, inclusive finance, elderly care finance, and digital finance) to improve the efficiency and effectiveness of financial services for the real economy, expanding institutional opening-up to boost the internationalization of Shanghai’s financial sector, and more.

Source: International Services Shanghai

2.Shanghai Introduces "Shanghai Sci-Tech Credit Score" to Refine Pricing Mechanism for Technology Insurance

[Keywords: Technology insurance]

The Shanghai Financial Regulatory Bureau of the National Financial Regulatory Administration and the Shanghai Municipal Commission of Science and Technology have jointly issued the Guidelines on Promoting the High-quality Development of Technology Insurance in Shanghai. The document introduces the “Shanghai Sci-Tech Credit Score” as an innovative approach to support more accurate insurance pricing. It encourages the deep integration of AI in vertical insurance sectors and innovates the technology insurance model of the industrial chain driven by “chain-leader” enterprises.

Source: Shanghai Financial Regulatory Administration

3.Lin-gang Special Area Releases Measures for the Administration of Legal Service Vouchers

[Keywords: Lin-gang Special Area, Legal service vouchers]

The Administration of Lin-gang Special Area of China (Shanghai) Pilot Free Trade Zone has recently issued the Measures for the Administration of Legal Service Vouchers in the China (Shanghai) Pilot Free Trade Zone Lin-gang Special Area. Under the new policy, eligible micro, small, and medium-sized enterprises, as well as sci-tech innovation and entrepreneurship teams, may apply for legal service vouchers to cover the cost of purchasing professional legal services.

Source: Shanghai Lin-gang

One Week in Shanghai

【Latest News】

1.Shanghai Launches “Easy Go” One-stop Service Platform for Inbound Tourists

[Keywords: “Easy Go” inbound travel portal]

Shanghai — widely recognized as the first stop in China for many international visitors — recently officially launched “Easy Go”, a one-stop aggregated service platform designed to enhance inbound travel experiences. Primarily available in English and equipped with real-time multilingual translation capabilities, the platform brings together a range of high-frequency services covering dining, transportation, culture and tourism, and shopping. It also provides timely access to key public information related to inbound travel.

Source: International Services Shanghai

2.Swiss Bluefaer Innovation Center Established in Yangpu

[Keywords: Swiss Bluefaer Innovation Center]

The inauguration ceremony of the Swiss Bluefaer Innovation Centre was recently held along the Yangpu waterfront. The establishment of the center marks a new milestone in fostering China-Switzerland friendship and cooperation. It aims to serve as a platform for deepening exchanges across various fields including economy, culture, arts, tourism, education, and social development, while promoting pragmatic cooperation, complementary strengths, and mutually beneficial growth.

Source: Shanghai Yangpu

【Forum & Exhibition】

1.11th China (Shanghai) International Technology Import and Export Fair Concludes Successfully

[Keywords: China (Shanghai) International Technology Import and Export Fair]

The 11th China (Shanghai) International Technology Import and Export Fair (CSITF) recently concluded with great success. A total of 155 on-site matchmaking sessions were held during the event, resulting in 684 project pairings and 814 direct engagements between technology managers and project representatives. A record 572 intended deals were secured—the third consecutive year exceeding 500.

Source: Shanghai Commerce

【Competitive Event】

1.Lin-gang Special Area Launches City Logo Design Contest

[Keywords: City logo]

To further enhance the Lin-gang Special Area’s city branding, the Administrative Committee of the China (Shanghai) Pilot Free Trade Zone Lin-gang Special Area has launched a public call for submissions of city logo design. The design should incorporate elements of “Shanghai Lin-gang” and reflect Lin-gang’s role as a key platform for national strategic initiatives and a frontier of China’s reform and opening-up. Submissions are expected to highlight the area’s geographical features, industrial strengths, and future development vision, fully capturing and conveying the urban identity of Lin-gang. The submission deadline is July 19.

Source: Shanghai Lin-gang

【Culture & Art】

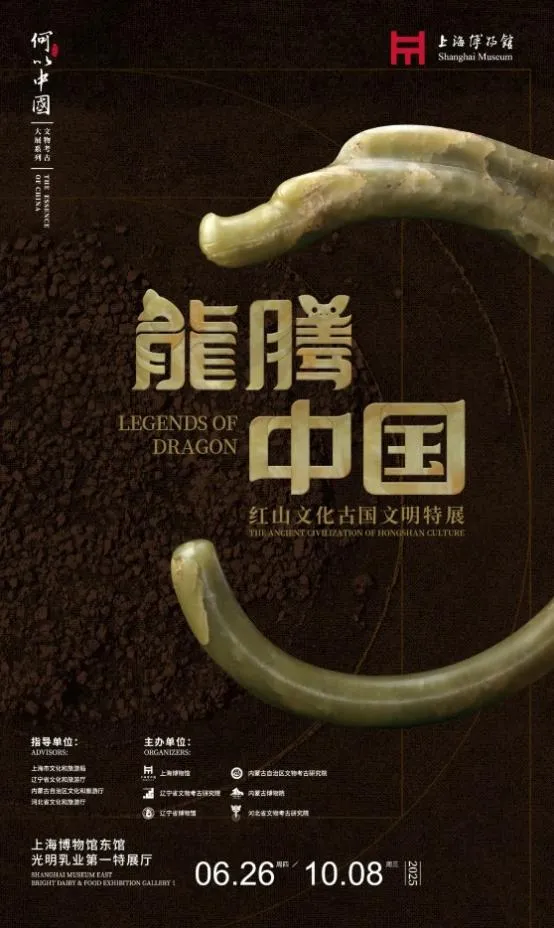

1.“Legends of Dragon: The Ancient Civilization of Hongshan Culture” to Open Soon

[Keywords: Hongshan culture]

On June 26, the Shanghai Museum East will host the opening of Legends of Dragon: The Ancient Civilization of Hongshan Culture. The exhibition brings together over 300 cultural relics, showcasing a century of archaeological achievements and recent discoveries related to the Hongshan Culture. It presents a vivid picture of the early formation of a unified belief system of the Hongshan Culture and ritual practices in the ancient statehood.

Source: Shanghai Museum

【Corporate Activities】

1.Infineon Unveils "In China, For China" Localization Strategy

[Keyword: Infineon]

Infineon Technologies recently launched its ambitious “In China, For China” localization strategy. The initiative focuses on a four-pronged approach — operational optimization, technological innovation, production deployment, and ecosystem development — to deliver greater value to customers and drive the company’s long-term, stable, and sustainable growth in the Chinese market.

Source: Zhangtongshe

2.First Batch of Wholly Foreign-owned Insurance Asset Management Companies Approved for Establishment in Shanghai

[Keywords: AIA Group, Aegon Group]

The National Financial Regulatory Administration has recently approved AIA Group and Netherlands-based Aegon Group to establish insurance asset management companies in Shanghai. These are the first wholly foreign-owned insurance asset management companies approved in the city, marking a significant step forward in enhancing Shanghai’s role as an international financial center.

Source: Xinhua Finance

【Training】

1.Corporate Carbon Credit Procurement Training to Be Held in July

[Keywords: Carbon credit]

On July 10, the Green and Low-carbon Development Branch of the Shanghai Foreign Investment Association (SHFIA), in collaboration with the Environmental Defense Fund (EDF), will host a practical training session on corporate carbon credit procurement. Through in-depth methodology analysis and case study sharing, the training aims to equip enterprises with end-to-end solutions for purchasing carbon credits, helping participants seize early opportunities in the carbon neutrality era and accelerate the development of sustainable competitive advantages.

Source: SHFIA

Q&A

Q: Officials from the National Financial Regulatory Administration (NFRA) and Shanghai Municipal People's Government answered reporters' questions on the Action Plan on Supporting Shanghai’s Development as an International Financial Center — How Will the Action Plan Enhance Shanghai’s Role as a Pilot Zone for Financial Reform?

A: First, a sound regulatory framework for financial innovation will be established. The Shanghai Financial Regulatory Administration will be supported in launching innovation pilots focused on serving the real economy and advancing financial opening-up. These pilots will be carried out under conditions of specified business scope, capped quotas, designated institutions, and predefined risk circuit breakers, and through interactive supervisory mechanisms.

Second, financial institutional opening-up will be further expanded in line with high-standard international trade and economic rules. The plan includes piloting cross-border syndicated loans and other non-resident lending businesses in the China (Shanghai) Pilot Free Trade Zone based on international best practices.

Third, the coordinated development of the Shanghai International Financial Center and the International Science and Technology Innovation Center will be deepened. Shanghai will be encouraged to explore financial service models tailored to tech enterprises under the principles of legal compliance and effective risk control.

Fourth, Shanghai will be supported in becoming an international green finance hub. Financial institutions based in the city will be encouraged to contribute to the development of carbon emission trading markets and to steadily carry out carbon finance-related business. Shanghai will also be supported in enhancing its competitiveness in shaping international carbon pricing mechanisms

Source: NFRA

Expert Perspective

Foreign Investment Access Regime in China’s Cell and Gene Therapy Industry: Policy Analysis, Industry Implications and Compliance Recommendations

By Zhang Qixiang, Cheng Junge, Zhang Menglin, and Deng Zike (Zhong Lun Law Firm)

[Continued from the Previous Issue]

I. Overview of the CGT Industry

(1) Cell Therapy

Cell therapy can be categorized into stem cell therapy, immune cell therapy, and other somatic cell therapies, based on the type and functional characteristics of the cells used.

(2) Gene Therapy

Gene therapy is classified into two approaches depending on the method of gene delivery into the human body: in vivo (gene modifications performed inside the body) and ex vivo (gene modification performed outside the body and reintroduced).

(3) Genetically Modified Cell Therapy

Some stem cell or immune cell therapy products involve gene editing or genetic modification techniques. These products possess characteristics of both cell therapy and gene therapy and are thus referred to as genetically modified cell therapy products.

II. Evolution of China’s Foreign Investment Access Policies in the CGT Industry

(1) Policy Vacuum Stage (Before December 2007)

In June 1995, the National Development and Reform Commission, the Ministry of Foreign Trade and Economic Cooperation, and the State Economic and Trade Commission jointly issued and implemented the Catalogue for the Guidance of Foreign Investment Industries. This catalogue was China’s first regulatory framework publicly outlining industries that were encouraged, restricted, or prohibited for foreign investment, and is commonly referred to as a “positive list”. It was intended to align foreign investment with China’s industrial restructuring efforts.

Since the release of the positive list, the Catalogue has undergone seven revisions to accommodate national economic and social development needs and industrial restructuring goals. Given the stage of development of the CGT industry in China, the versions of the Catalogue revised and implemented prior to December 2007 made no reference to the CGT sector. As such, the CGT industry remained outside the scope of foreign investment access policies during that period, representing a regulatory blank spot.

[To be Continued]