How should your annual bonus be taxed?

With the Chinese New Year around the corner, you may be wondering how to minimize tax on your annual one-time bonus, or year-end bonus. Here's what you need to know.

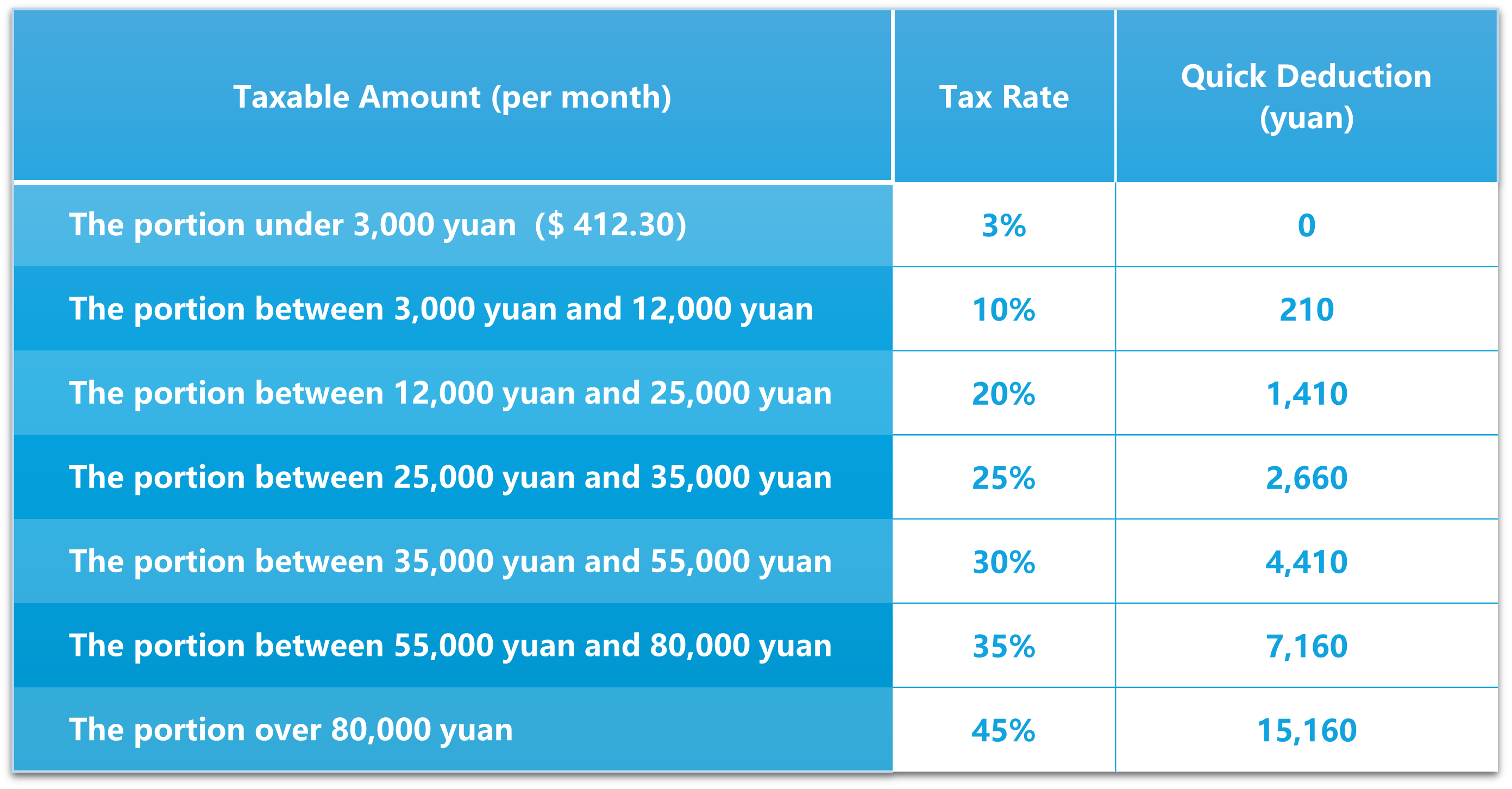

According to tax policies, your annual bonus can be taxed separately from your annual comprehensive income. To calculate, the bonus amount is divided by 12 to determine the applicable tax rate and quick deduction, as outlined below:

The calculation formula is:

Tax Payable = Annual Bonus × Tax Rate - Quick Deduction

The calculation works like this:

For example, if your year-end bonus is 15,000 yuan:

1. Divide 15,000 by 12, which equals 1,250 yuan.

2. Since 1,250 yuan is less than 3,000 yuan, the applicable tax rate is 3%.

3. The tax payable is calculated as 15,000 yuan × 3% = 450 yuan.

You can also add the bonus to your annual comprehensive income. To determine the most cost-effective option, use the individual income tax (个人所得税) app, which calculates results for both methods and allows you to choose the one with lower taxes.

Note that this taxation method can only be applied once per year, so make your choice carefully!

Source: Official WeChat account of the Publicity Department of the CPC Shanghai Pudong New Area Committee