FAQs on annual report submission for foreign-invested enterprises

Foreign-invested enterprises that were lawfully established and registered in China by Dec 31, 2024 are required to submit their 2024 annual foreign investment information report from Jan 1 to June 30, 2025.

Why is it obligatory to submit annual reports?

1. Failure to disclose or submit annual reports as required by law and regulations may result in the enterprise being listed in the registry of abnormal operations by the registration authority, with fines of less than 10,000 yuan ($1,385).

2. Being listed in the registry of abnormal operations will lead to public announcement through the National Enterprise Credit Information Publicity System.

3. Once listed in the registry of abnormal operations, the enterprise may face restrictions or bans in areas such as loans, government procurements, project bidding, state-owned land transfers and the granting of honorary titles, significantly affecting its development.

4. When an enterprise fails to submit annual reports for two consecutive years as required and does not rectify this while being unreachable at its registered address or place of business, its business license may be revoked by the administration for market regulation at or above the county level.

How to present annual reports?

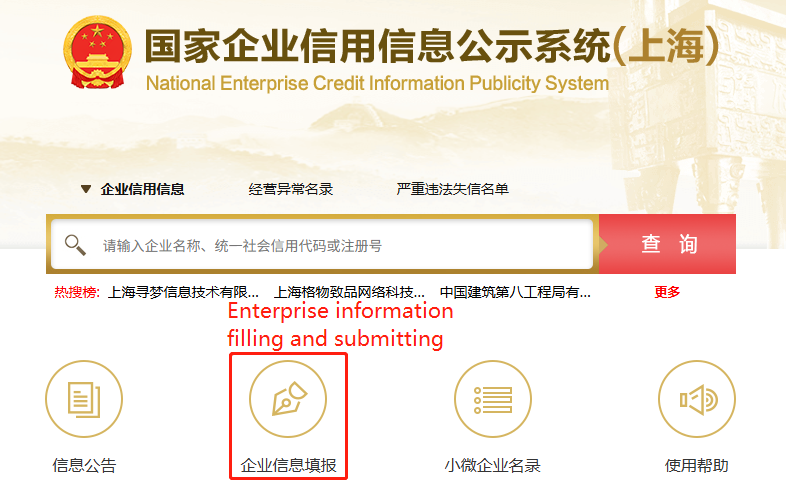

1. Log in to the Shanghai section of the National Enterprise Credit Information Publicity System, click on "Enterprise information filling and submitting" and then fill out the annual report truthfully step by step.

2. Enterprises can also navigate to the "Efficiently accomplish a task" section of the "Government Online-Offline Shanghai" official e-governance platform at https://zwdt.sh.gov.cn/govPortals, and click on "Enterprise data filling and submitting" to access the annual report page.

What are the must-knows for submitting annual reports?

The revised Interim Regulations on Enterprise Information Publicity, officially implemented on May 1, 2024, include new provisions on the authenticity of disclosed enterprise information.

Enterprises found to have concealed or falsified information in their public disclosures will face penalties as per relevant law and regulations.

When there is no specific regulation, the administration for market regulation may order corrections and impose fines of over 10,000 yuan to below 50,000 yuan, or more than 50,000 yuan to less than 200,000 yuan for severe cases.

For severe cases, the enterprise will also be included on the serious violations and dishonesty list and may have its business license revoked.

Is there any fee for presenting annual reports?

Please note that there is no fee for submitting annual reports!

Source: State Administration for Market Regulation