FAQs on tax incentives for exhibits sold at 8th CIIE

Q1: What tax preference will be given to exhibits sold at the 8th China International Import Expo?

A: According to the notice jointly issued by the Ministry of Finance, the General Administration of Customs, and the State Taxation Administration, a reasonable volume of imported exhibits sold at the CIIE is exempt from import tariffs, import VAT, and consumption tax.

However, the following items are excluded from the preferential tax policy:

- Commodities prohibited from import by China

- Endangered animals and plants, along with their derived products

- Tobacco, alcohol, and automobiles

- Goods listed in the Catalog of Major Technical Equipment and Products Unqualified for Import Tariff Exemption

Q2: What are the "reasonable sales volume and sales revenue" for eligible exhibits?

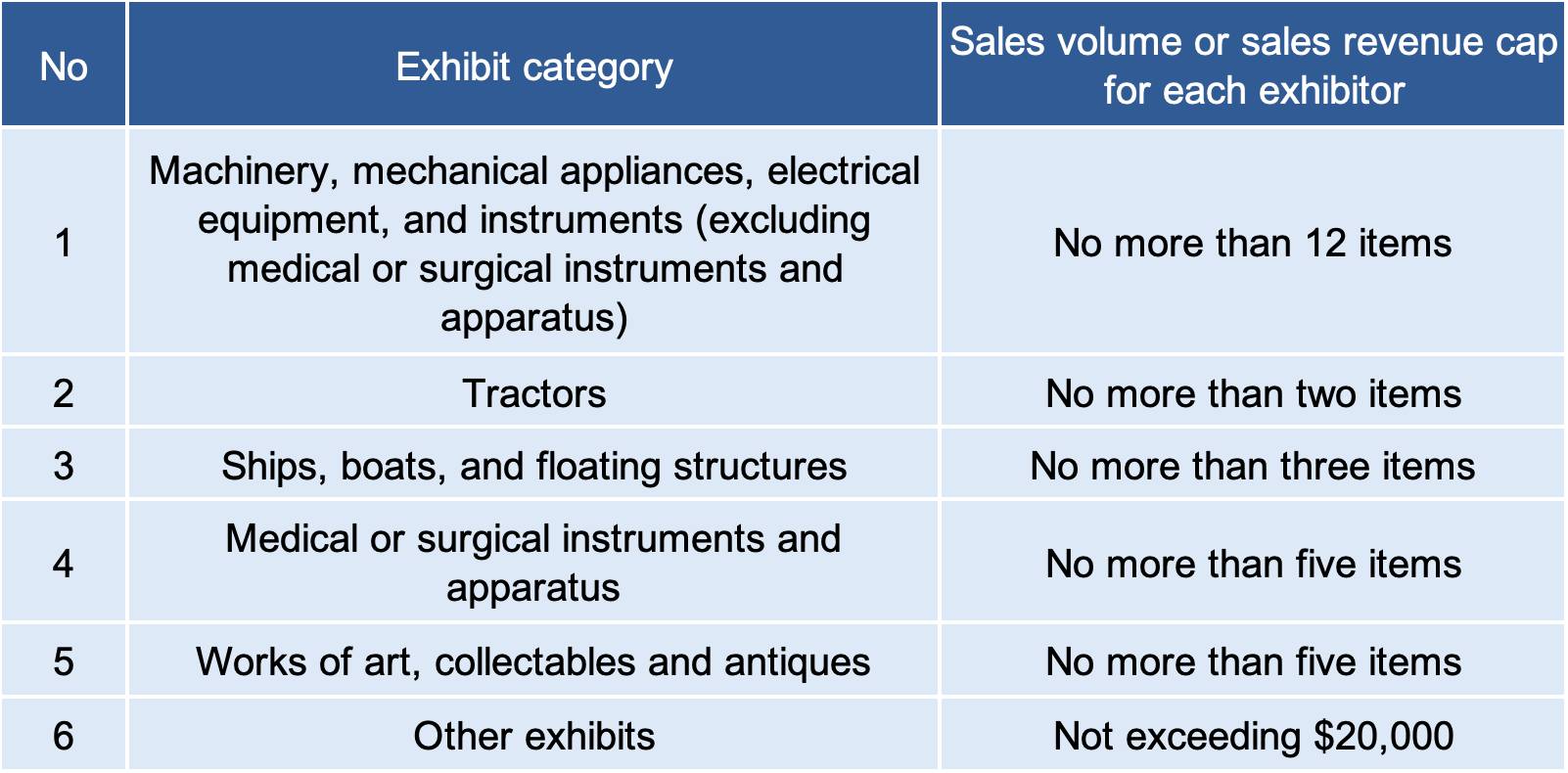

A: The "reasonable sales volume and revenue" are defined as follows:

- For exhibits listed in Categories 1-5 of the Appendix, the policy applies to sales volumes not exceeding the limits specified in the Appendix for each exhibitor.

- For other exhibits, the policy applies to sales revenue not exceeding $20,000 for each exhibitor.

For exhibits sold at the CIIE that surpass the sales volume or sales revenue limits, as well as unsold exhibits that are not to be re-exported after the expo concludes, tax shall be levied according to the relevant rules and regulations of China.

Appendix: Eligibility for tax preference

Q3: How to define "sold at the CIIE"?

A: This term refers to:

- Contracts are signed from Nov 5-10

- The contracts are confirmed by the National Exhibition and Convention Center (Shanghai) Co Ltd

- Obtain the confirmation sheet of exhibits eligible for tax preference at the China International Import Expo

Q4: How to apply for the preferential tax policy?

A: The NECC (Shanghai) or exhibitors' designated freight forwarders at the main venue shall submit the confirmation sheet and relevant customs clearance documents in paper form to the Customs to apply for the policy for imported exhibits.

Upon review, exhibits that are not eligible for the policy shall be subject to import duties in accordance with the prevailing regulations.

In case of any policy changes within the year, the official announcements by the authorities shall prevail.

Source: Shanghai Customs

Note: The above content is for reference only. In case of any discrepancies, the Chinese version shall prevail.