FAQs: Individual income tax annual settlement

The deadline for annual individual income tax settlement is June 30. Here are some frequently asked questions from expats. Make sure to file on time!

[Photo/VCG]

According to the announcement from the State Taxation Administration, the deadline for filing personal income tax for the year 2023 is June 30. Taxpayers can handle the settlement through the Individual Income Tax App or website. They can also opt for postal submission or in-person processing at a local tax bureau. Here are some of the most frequently asked questions on filing personal income tax.

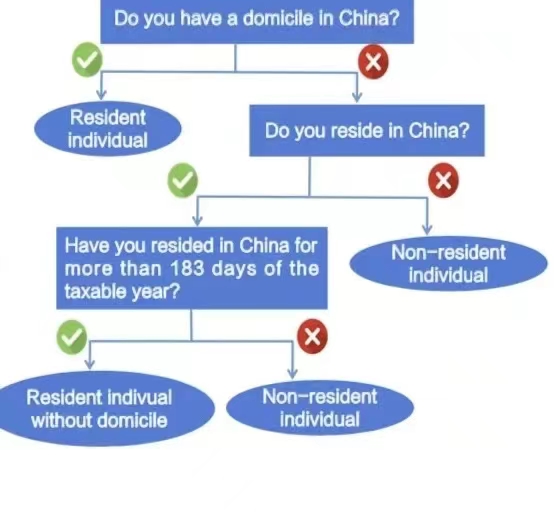

Q: As a foreign individual, how do I know whether I need to make an annual individual income tax settlement?

A: Foreign individuals are required to file personal income tax annually if they have a residence permit. Non-resident individuals do not need to do that. You can refer to the illustration below to determine whether a foreign individual should file personal income tax in China.

Q: How can a foreign individual file an annual tax return without pre-filed information?

A: You can check the details of your income and tax declared through "Income/Tax Details Query" in the Individual Income Tax App, and then fill out the data in the annual return.

Q: I renewed my passport last year and then used it to declare my salary. What should I do if the income details are not fully displayed when I check them?

A: If you have used multiple ID numbers to file tax returns in one year, in order to calculate the annual income and deductions accurately, please first visit the tax authorities to merge multiple individual tax files.

Q: Since my company has helped me withhold my individual income tax from my salary every month, why do I have to make remedial payments during the annual settlement?

A: There are three common reasons:

1. If you hold positions and receive salaries from multiple employers, the basic deduction of 5,000 yuan ($687.88) has been deducted multiple times when withholding tax, and you need to make remedial payments during the annual individual income tax settlement process.

2. If you change your job during the year and a lower tax rate is applied when withholding tax after the annual comprehensive income is consolidated and calculated, this may result in a higher comprehensive income tax rate than the withholding rate, and you will need to make remedial payments.

3. In addition to wages, labor remuneration, author's remuneration, and royalties are also taxable. After the total of all comprehensive income is summed up, it leads to the application of a comprehensive income tax rate that is higher than the withholding rate, thus remedial payments are necessary.

Q: Why can't I bind my bank card on my Individual Income Tax APP?

A: Due to reasons such as mismatched names for foreigners, if the bank card cannot be verified by UnionPay, you can bring relevant supporting documents issued by the bank and your personal ID to a local tax bureau for processing.

For more information about filing personal income tax, you can call the 12366 tax service hotline, which provides multilingual services.

| Reminder: |

| If your annual individual income tax settlement involves applying for a tax refund, after submitting the tax refund application, you also need to pay attention to the internal messages in the Individual Income Tax APP. For example, you may need to submit relevant documents such as entry and exit records or rental contracts. Failure to submit documents in time may lead to the refund being unsuccessful. |