How to file your individual income tax return

The personal income tax filing season in China officially started on March 1. If you're an expat working in Shanghai with a valid residence permit, you are also required to file your tax return.

You can file the individual income tax return through your employer or a third-party agency. In this guide, we will show you how to file the tax return on the "个人所得税" app.

Related: FAQs about individual income tax annual settlement

First, search for “个人所得税” (Individual Income Tax) in your app store.

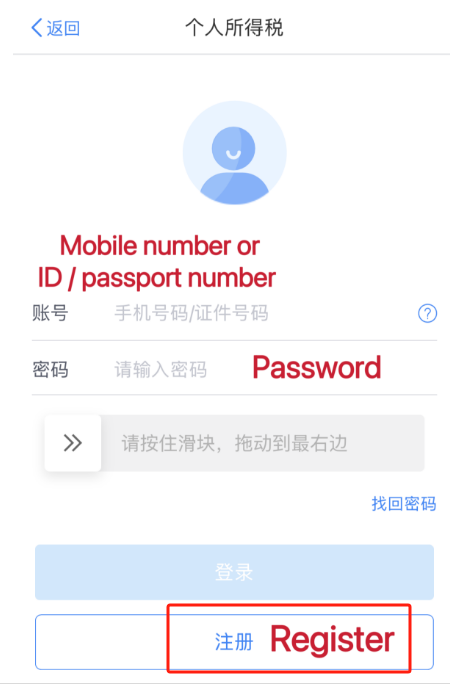

Once the app is installed, fill in the registration information to create an account.

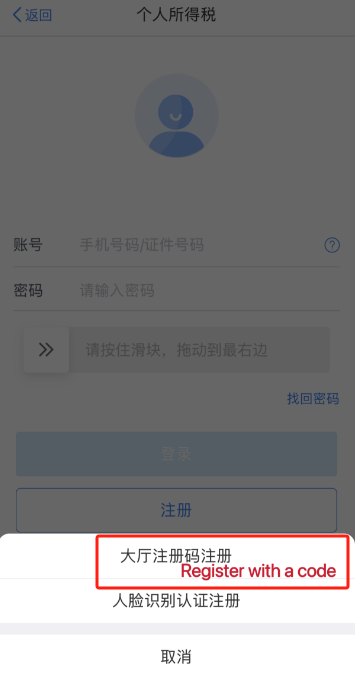

Click “注册” (registration) and then “大厅注册码注册” (Code registration)

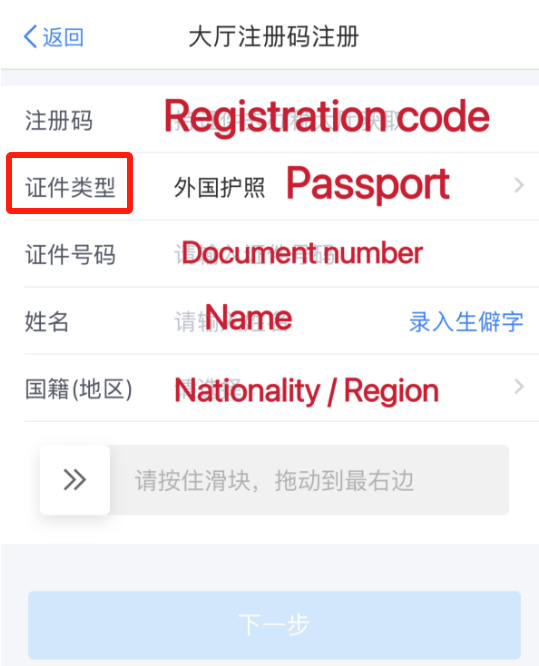

| Note: You are required to personally obtain the login code at the tax bureau counter. Please remember to bring your passport. |

You will be prompted to complete your personal information, including your ID type, passport number, name, and nationality.

Click the button to proceed to the next step. Choose a password, input your phone number, and choose your address.

Once you have completed the registration process, you can log in with a gesture password.

Then you need to bind a bank card.

In your personal profile, click “银行卡” (Bank card) to add a new card. This card is used for tax return or payment.

Now go to the homepage, and you can see different functions, including “Annual settlement of comprehensive income”, “Tax payment details”, and “Get tax records”.

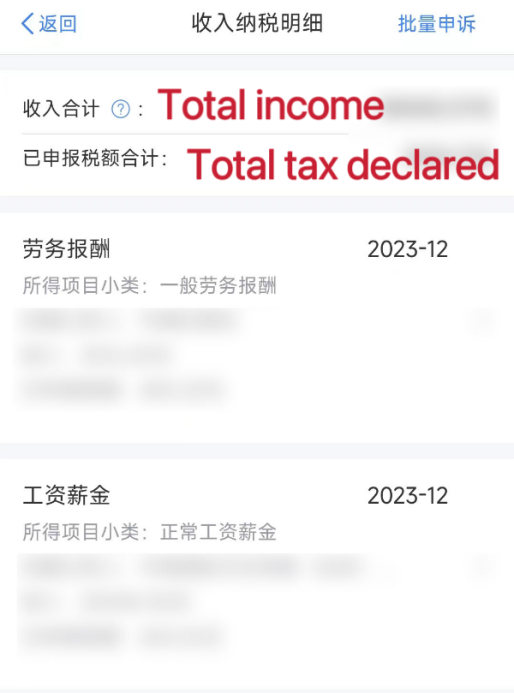

In “纳税收入明细”, you can see the tax details of four types of personal income – wages and salary, labor remuneration, author’s remuneration, and royalties.

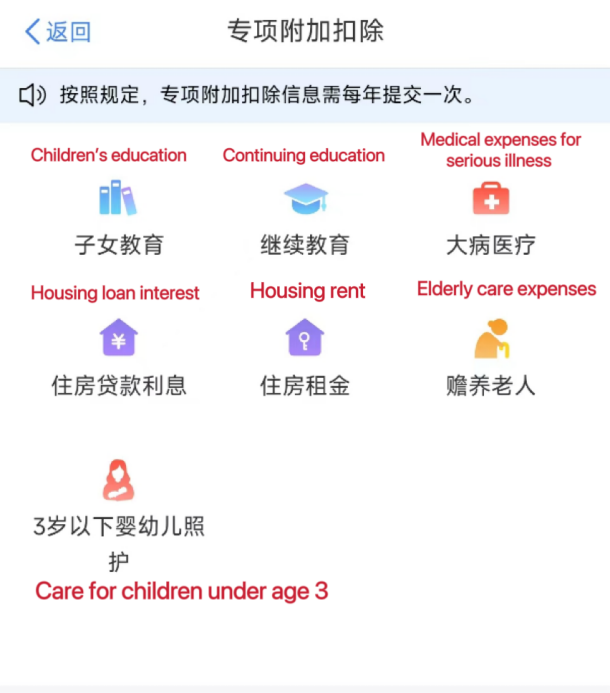

Before applying for a tax return, you need to add items for special additional deductions, which allows for tax exemptions. Click “办&查” (Services & Information) at the bottom, and choose “专项附加扣除”.

There are seven items you can choose: education of children, continued education, healthcare costs for serious illness, housing loan interest, rent, supporting the elderly, and nursing children under three years old.

Now you can enter the “综合所得年度汇算” (Annual settlement of comprehensive income) to apply for the annual tax return.

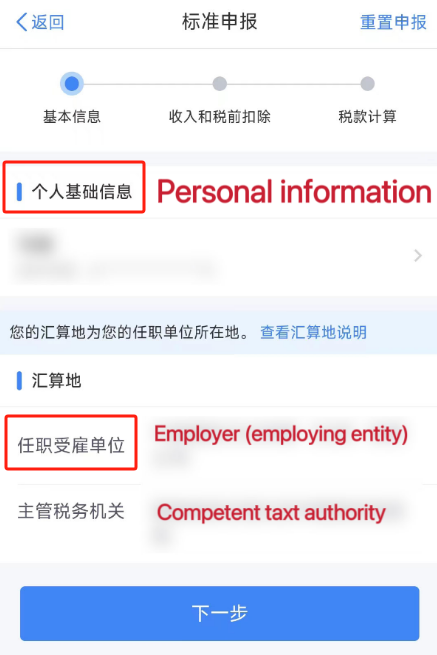

Confirm the basic information and select “任职受雇单位” (Employer) and go to next step.

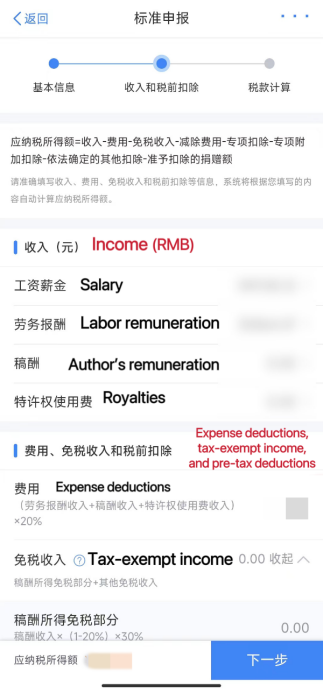

After entering the information page of income and pretax deduction, confirm whether data of wage and salary, other types of income, and special additional deductions are correct.

If there are other deductions, such as annuities, commercial health, tax-deferred endowment insurance, or personal pension, you can add under “其他扣除项目” (Other deductions).

The tax payable will be displayed at the bottom. After checking the information, click the blue button to go to next step.

Now you enter the tax calculation interface. According to the data filled in before, the refundable tax will be displayed at the bottom left.

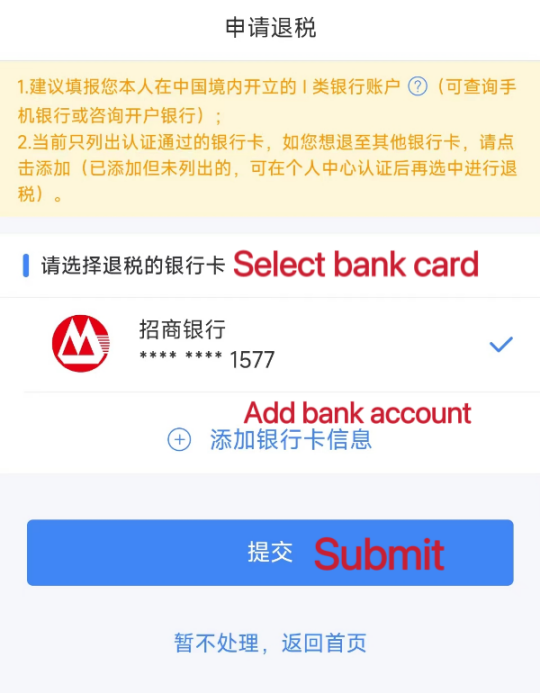

If the declaration is successful, you will jump to the refund page. Click “申请退税” (Apply for refund).

Select the bank card and click “提交” (Submit).

Now you have finished the declaration. Wait for the tax authorities to review your tax filing.

For inquiries regarding individual income tax, you can call the 12366 tax service hotline.