How to get personal income tax records

As a foreign employee, you can get your individual income tax document on the website of Shanghai Municipal Tax Service or the Individual Income Tax app.

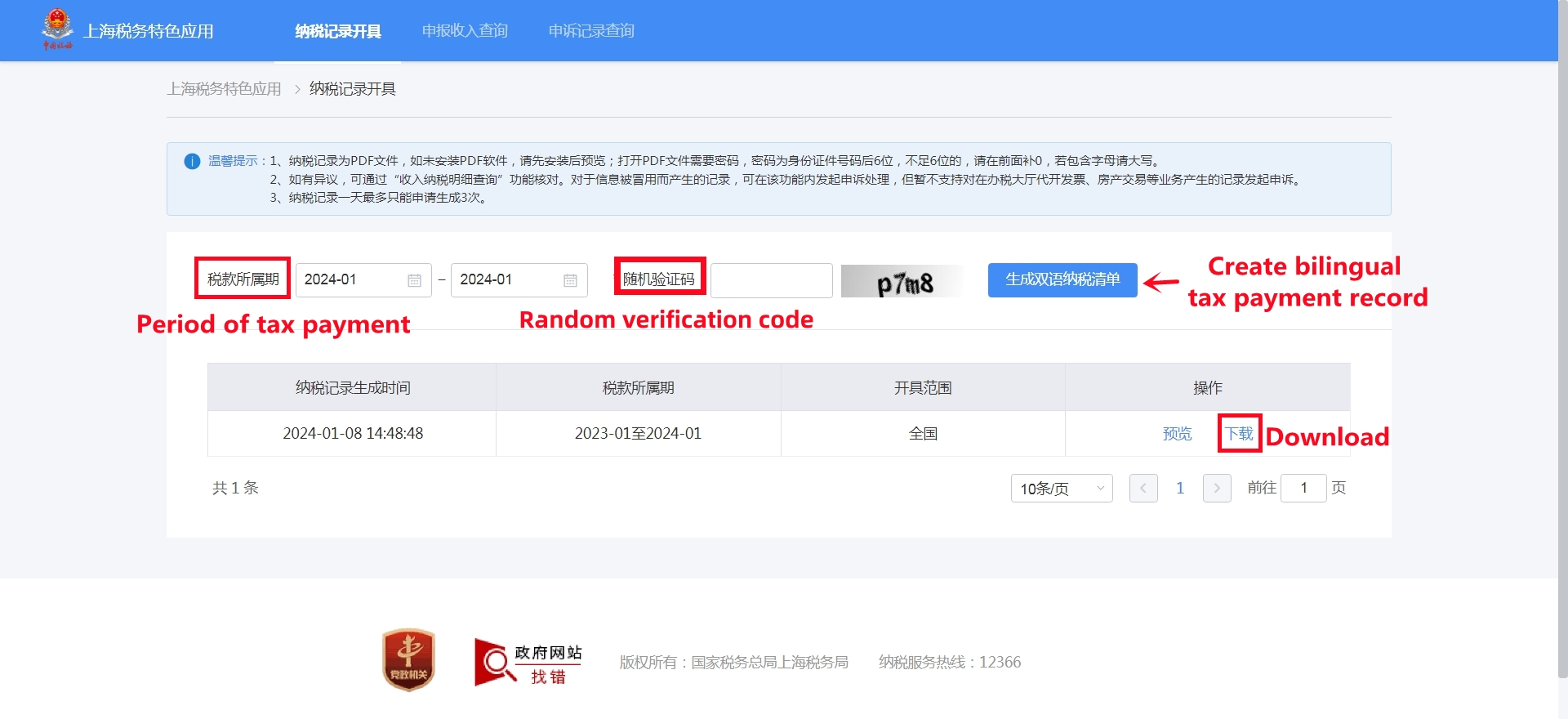

Using the website of Shanghai Municipal Tax Service:

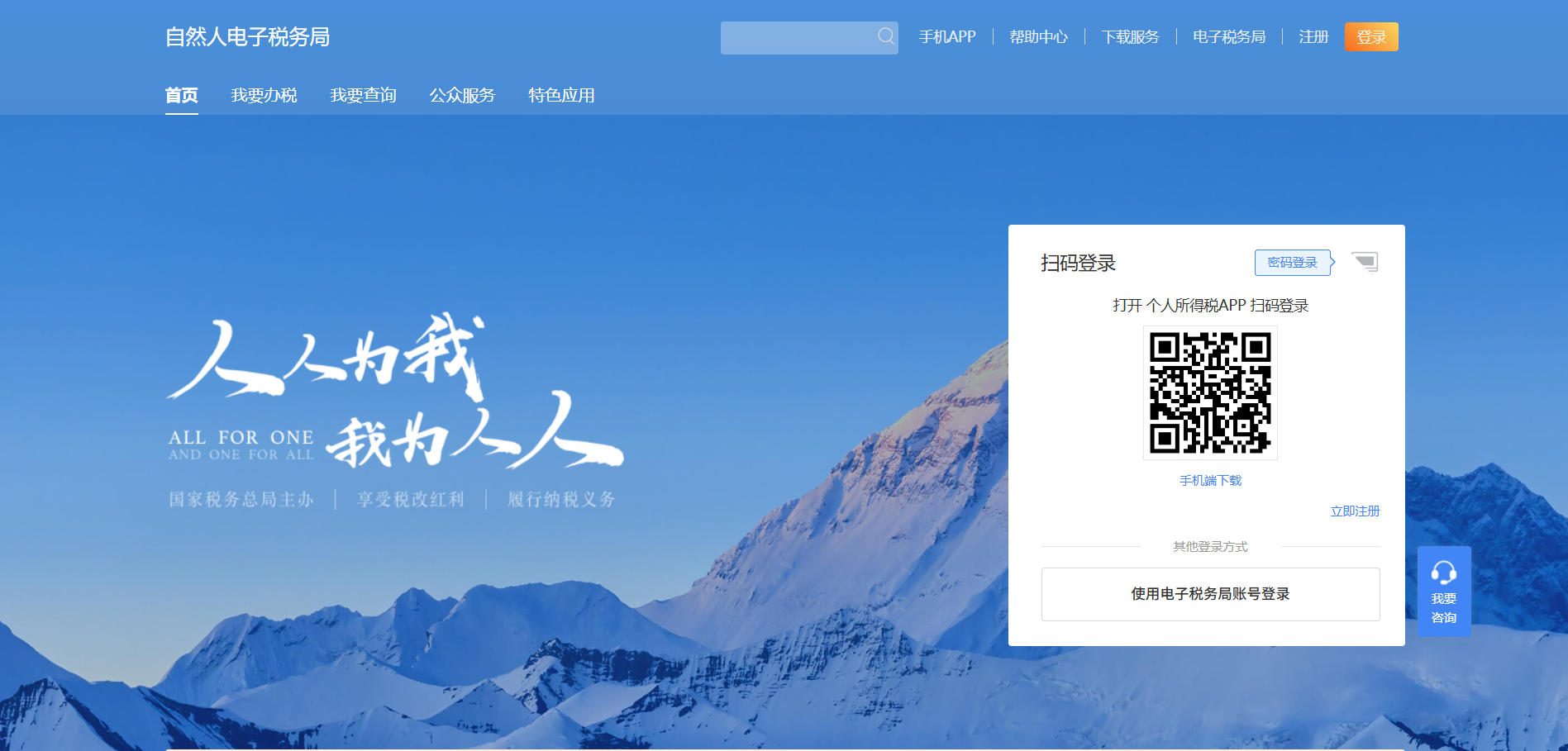

1. Go to the Shanghai Municipal Tax Service website and click the "Natural Person Electronic Tax Service" tab.

2. Go to the login page.

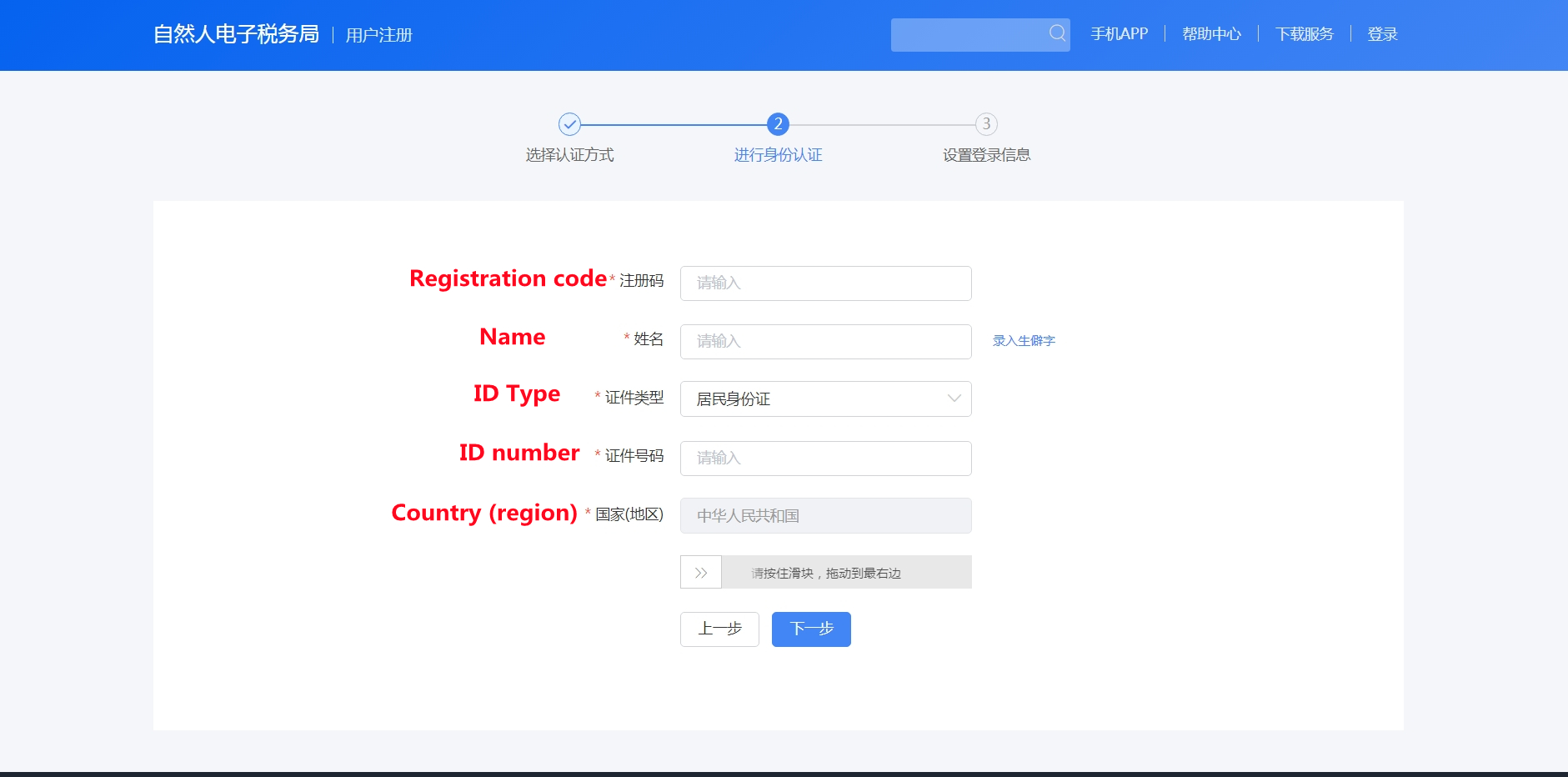

3. If you are a first-time user, you need to complete registration first.

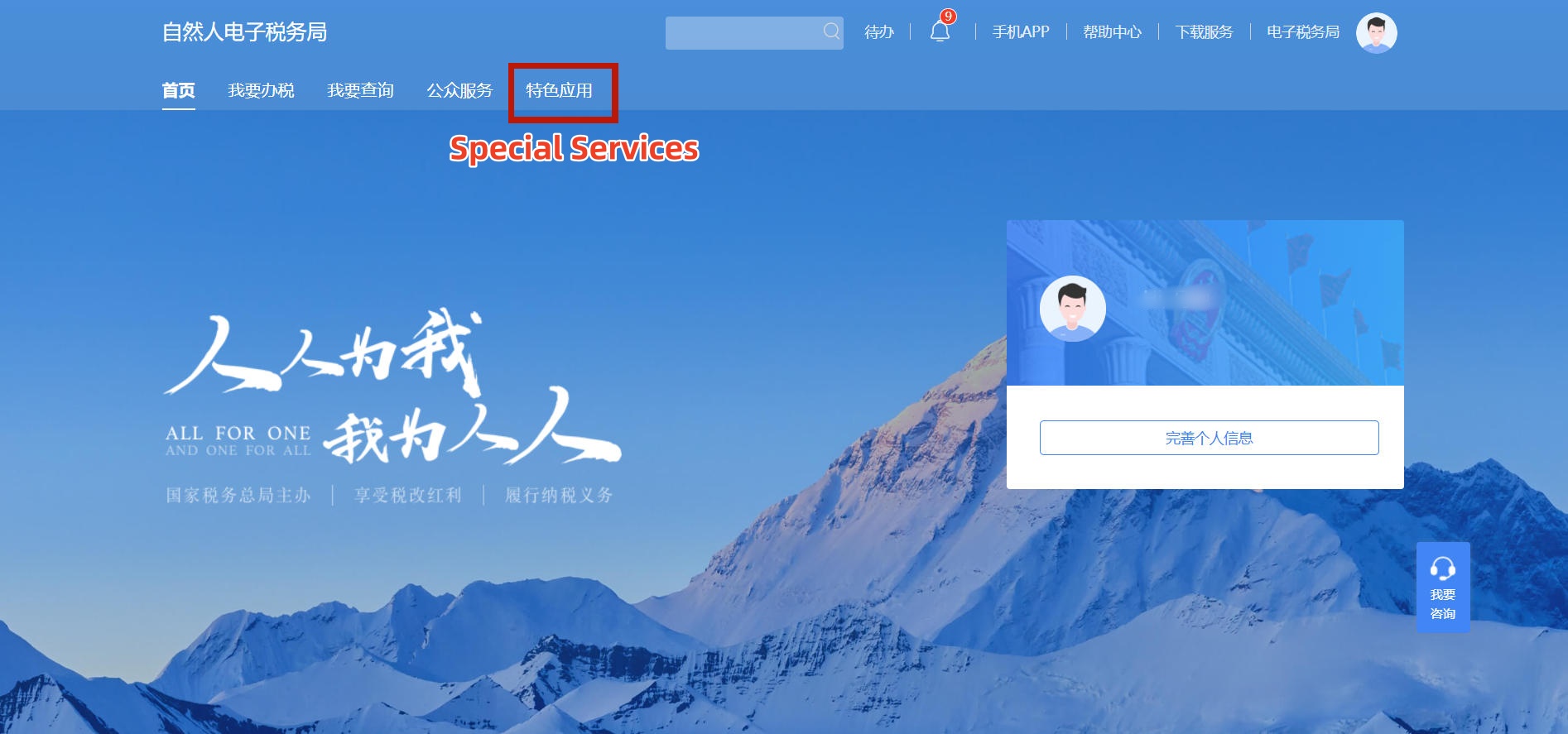

4. After login, click "Special Services".

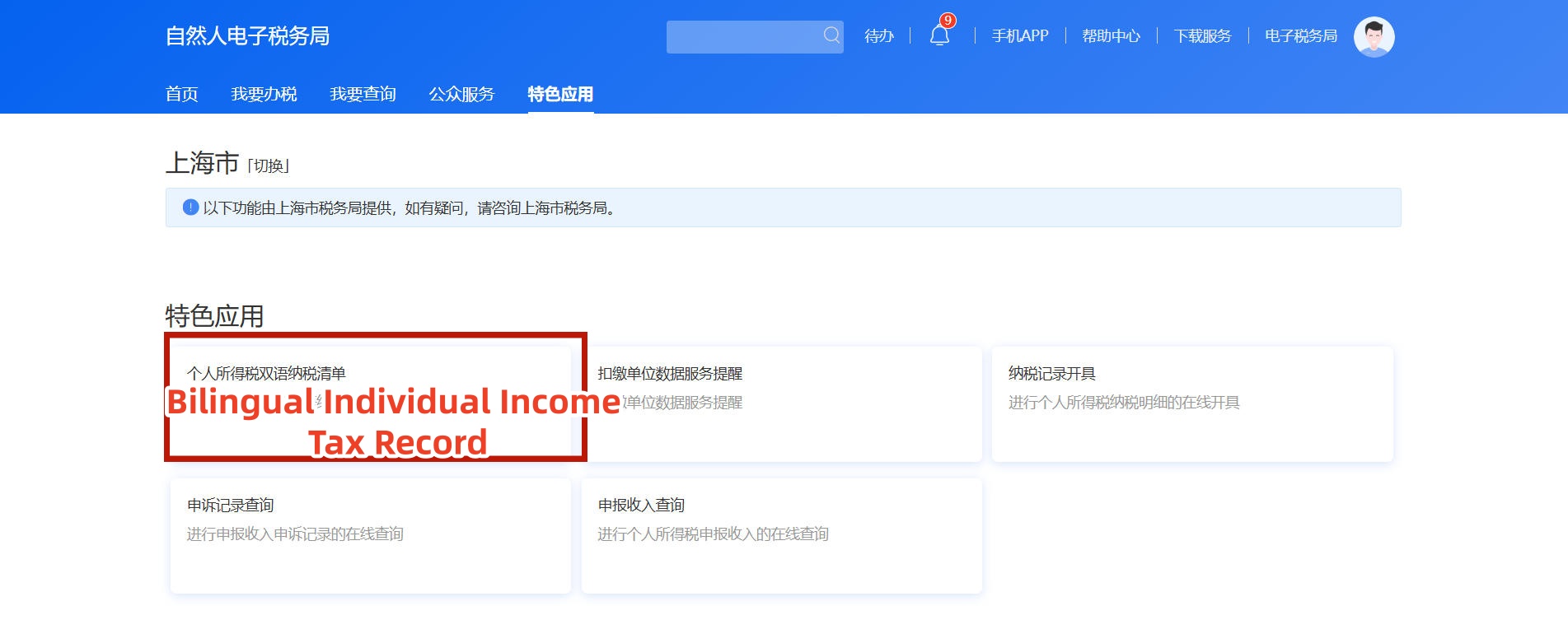

5. Choose your place of residence.

6. Click "Bilingual Individual Income Tax Record".

7. Select the tax payment period and type in the verification code before generating the bilingual tax payment record.

Note: A password (the last 6 digits of your ID) is required to open the tax payment document (PDF).

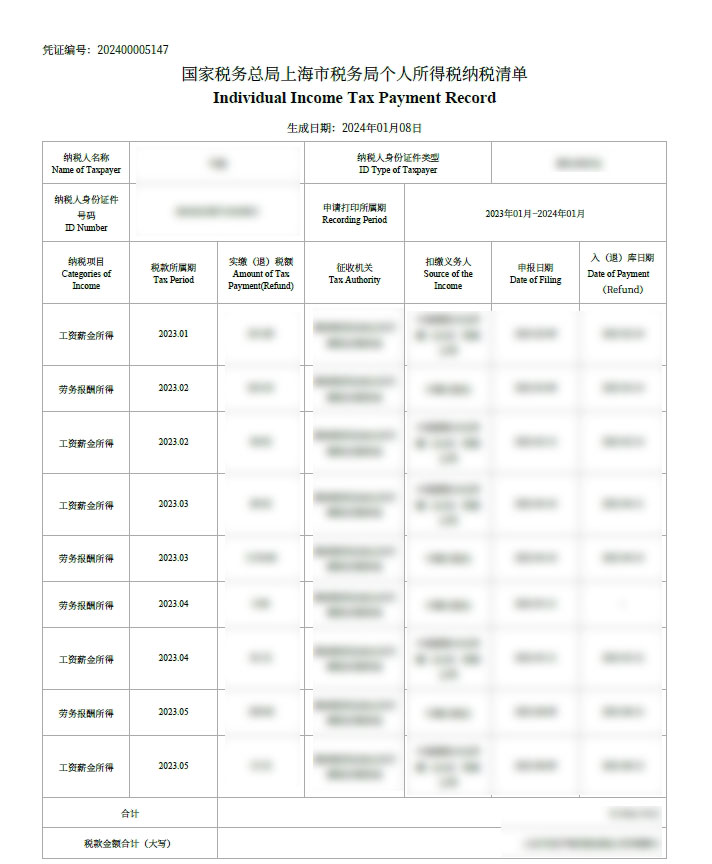

After you input the password, the tax payment record will open.

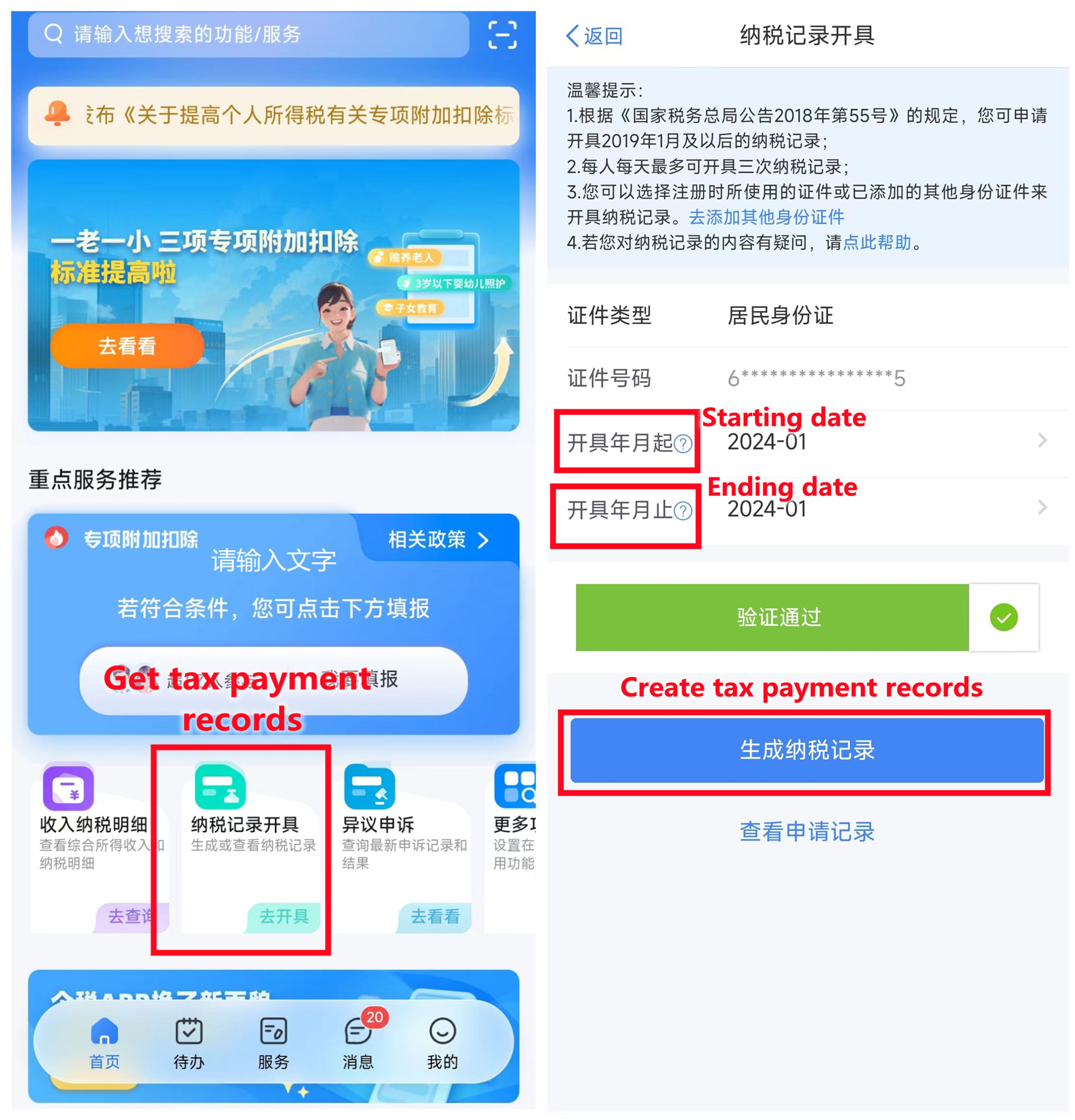

Using the 个人所得税 Personal Income Tax app:

1. Download the app.

2. Open the app and click "Get tax payment records" and select the payment period before creating the tax payment record.

You may also visit the taxpayer service hall of Shanghai to acquire the records with valid identification.

Documents required

You will need to visit the taxpayer service hall with your original ID to get the individual income tax records.

If you entrust others to get the document, both your original ID and that of the trustee are needed as well as written authorization.

Updated Oct 13, 2025

Source: Shanghai Municipal Tax Service